Financial Rooftop Koreans

When it comes to your capital, nobody is coming to save you. Nor should they, because you are not supposed to be outsourcing your knowledge and decision making to someone who cannot possibly care more about it than you. Yet that is what we have been taught to do, to trust the experts, because we could not possibly understand it ourselves.

Not only is nobody coming to save you, but the unfortunate reality is quite the opposite. Vampires, so goes the tale, must be invited in. We have collectively invited the vampires into one the most important aspects of our lives- our finances. The damage of this passive submission to the enemy at the gates is catastrophic, and has taken the form of a crippling retirement crisis for the older generations and a dejected helplessness expressed by the youth with regards to their financial future.

When it comes to finances, the vampires are the government and financial institutions. When you begin to accumulate the fruit of your productive labor, they smell blood. Desperate for their cut, they take on various forms such as excessive exposure market volatility, income tax, estate tax, gift tax, property tax, inflation, published and hidden fees, liability, disability, legislative malpractice, and cartelized fractional reserve banking, to name a few. Whatever their form, they will be perpetually in pursuit of your wealth, always trying to scale the castle walls, eager to bleed you dry.

With such a relentless assault on multiple fronts, and the attack coming from previously trusted institutions, the best thing you can do once you see through the conventional 'wisdom' is to become a financial ‘Rooftop Korean.’

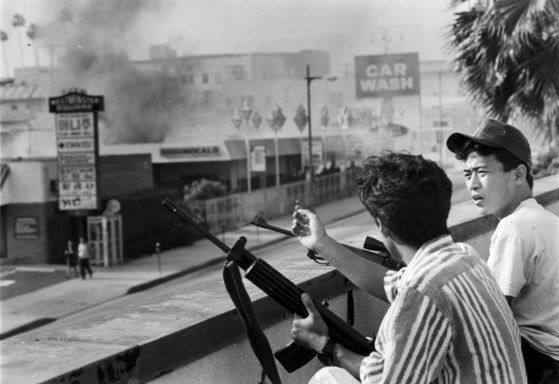

The legend of the rooftop Koreans stems from the 1992 LA riots, when South Central Los Angeles was being vandalized and burned to the ground by protestor furious about the verdicts for the cops in the Rodney King excessive force trial. Much could be said about the outrage, and much has been speculated about the crimes which led to the eventual arrest and beating. Despite my penchant for being unashamedly controversial in my writing, I feel no need to speculate on any aspect of the events prior to the reality on the ground which found the Koreans on the roof.

The situation at that moment was that cars and buildings alike were being torched in the path of the (mostly peaceful?) protestors. Apparently there was prior tension between the LA Korean community and the black community, and thus the Koreans found themselves on the wrong end of the rioter’s outrage, despite no involvement in the events which precipitated the riots. Rather than wait for someone to save them, they did something we must all be prepared to do: they took up arms and protected their property.

They knew the police would not be coming to save their businesses from being senselessly burned to the ground, as they were obviously preoccupied, themselves the focal point of the riots. The images of the rooftop Koreans defending their castles against arson, be they small businesses or restaurants or apartments, are a visceral reminder of the need to be prepared to defend what you have built.

The government being the rioters in this case, it is of utmost important that we understand the battle space and come prepared with a foundational knowledge of the rules of battle. We will lose every time we show up unprepared, or worse yet, expect they themselves to come to our aid. Preparedness looks like understanding the flow of capital in and out of our lives, and where we are exposed. It looks like a deep understanding of the products we have and how they integrate into each other within our overall strategy.

Many clients come to the table without goals defined, and if they have goals they have no codified strategy to achieve them. Often if they do have a strategy, we can easily identify numerous inputs that would derail the entire plan. We must remember that the vampires will never stop coming, so we cannot afford to leave any aspect of our strategy exposed to unnecessary risk or loss of control.

The takeaway here is that you are indeed capable of acquiring this knowledge. You do not need an expert to hold your hand through every financial decision you make, you can arm yourself and climb up to the roof to defend your own castle. This applies to all aspects of our lives, not just our finances. The next time you are told that your money is automatically going to be locked into a 401(k) for decades that you don’t understand and did no research on, recall that feeling of confusion when they took your baby from you immediately after birth to administer a vaccine against an STD. When they say to buy term and invest the difference, and that investment comes with no certainty of value when the term expires, remember that your doctor recommended your toddler get a COVID vaccine that he said was safe and effective despite never seeing the safety tests because you know they never made it past animal trials due to killing all animals tested. When you are told by your CFP that you need to be diversified in market funds you can’t even name, try looking in your pantry to find a ‘healthy’ snack that isn’t loaded with seed oils and chemicals you can’t name.

It’s up to you to read the ingredients list. It’s up to you to read the fine print. It’s all there, the entire list of poison, be they seed oils in your food, horrific heavy metals in the vaccine you are about to allow to put directly in the bloodstream of the miracle of life you created, or clause after clause of risk being shouldered by your capital in the mutual fund that can’t lose per a misapplication of the average rate of return. Revelation of method requires that they tell you they are tricking you, thus if you fall for it the cosmic burden is not on them, or so they say. Just ask your pediatrician for the vaccine insert and actually read the ingredients and the endless warnings of severe risk out loud, then gauge their reaction or see if they have even read it themselves (they haven’t). Ask your CFP who to call when the market takes a 25% haircut and see if you don’t get a blank stare that implies ‘obviously, there is nobody to call, but the market will go up eventually, because… it does.’ You don’t have to take their word for it, do the actual work to understand what is trying to get through the gate, whatever realm of responsibility we are talking about. It’s your family, after all, and nobody cares more about them than you do. If you choose not to read the fine print, you can expect the results you see around you.

Reliance on experts has led us to the pathetic financial shape we are collectively in today as well as the abysmal health standards we have come to accept in this country. We don’t crack the top 25 in retirement satisfaction, despite trillions of dollars poured into retirement vehicles. Why? Because rather than understanding the forces working against us and setting ourselves up with a vantage point to counter their relentless attacks, we lazily just opened the door to them because we were too unshapely to climb the stairs to the roof. This is further demonstrated in our knee-jerk reaction to any crisis- ‘what is the government going to do about this?’ Be it a natural disaster or a financial crisis, we look first to them to get us out of the mess. Even if they created the mess, we are still Americans who must seek our own remedy and look to our own foundations and our community for support and wisdom, not the bloated administrative state masquerading as leaders.

Despite what you may think, given our passion for the content discussed here, we are not dogmatic about these topics. Believe it or not, we don't recommend infinite banking for everyone who comes to us; we don't see it as a miracle cure for everyone, though it is a powerful foundational tool that most of our readers would be well served by. And though we discuss our journey with researching vaccines in a recent podcast episode, I know not everyone will agree, and that is obviously fine. The reason we approach our content with such a forceful tone is that we want everyone to be exposed to a counter-narrative that they otherwise would not find. If you don't seek it out, you will never hear a hint of vaccine skepticism, nor will you learn the power of dividend-paying whole life insurance, for example; these are simply not topics you fall into casually. They must be sought out, and there is a wide body of knowledge on these and other topics. But one can go through our 'education' system, an entire working career, and raise a family for decades without ever having reason to question conventional wisdom. We push these ideas forcefully because we want to set them on an equal footing as the conventional wisdom: vaccines are safe and effective miracles, the market always goes up, buy term and invest the difference, and so on. If we can expose critical thinkers to another way to approach such decisions, I consider that a win. It's not I think that you have to take the same approach on vaccines as our families chose to, it's that the decision you make, even if it is fully in line with conventional wisdom, is your own well-researched decision. Perhaps you evaluate infinite banking from a true willingness to learn, and decide to go the typical conventional financial planning path instead; that is great and we hope it serves you well. Where we see people falling short is trodding aimlessly along the path of least resistance, taking no ownership of their decisions. The results are in for the CFP model, the modern health paradigms, and the state of childhood health, and to us, we as a nation are way off course. But if you believe otherwise, we hope you considered another viewpoint to come to a better-formed conclusion.

Take back control. Stop being a passenger. Stop outsourcing your critical thinking. Don’t take our word for it when it comes to whole life insurance and the infinite banking concept, do your own research and be able to explain what you have and what you are trying to do. Our clients must meet a threshold of knowledge before we will set them up with the tools we use, because we want them to become their own bankers, not just rely on us to open a policy and guide their usage. For the first time, in almost all cases, they dive deep into the mechanics and regulation of a product they are considering purchasing. They invariably have no idea who the custodian of their 401(k) is, and they don’t know how to find the contact information for the agent that sold them a term policy on the advice that ‘whole life is a scam.’ But now they are ready to tie up the loose ends in that financial junk drawer and actually take back control and autonomy over their financial decisions. That is what we require of our clients.

Will you take a knee in submission to the protestors, allowing them to scale your castle walls? Or will you take up arms and accept that the burden is on your shoulders? Whatever strategy you opt to use to achieve your financial goals, it is imperative that you do your due diligence to ensure that when you are on the rooftop, you are able to identify the vampires and effectively neutralize them. Otherwise, why even try? Take another booster, scatter your money into an assortment of mutual funds and pray the market and the Fed come through for you. But your family deserves better, and you have the capability and means to learn for yourself. If infinite banking is your preferred means of ensuring your castle is protected, we are here to help you train and be ready for the fight; if you chose another route, do it wisely and take ownership of the process. But make no mistake, there will be a fight, and you must decide as a father if you will fight on behalf of your family or surrender them to the vampires.

Now, to the roof!